Northern Governors reject proposed derivation model for VAT distribution in new tax bill

Northern Governors reject proposed derivation model for VAT distribution in new tax bill

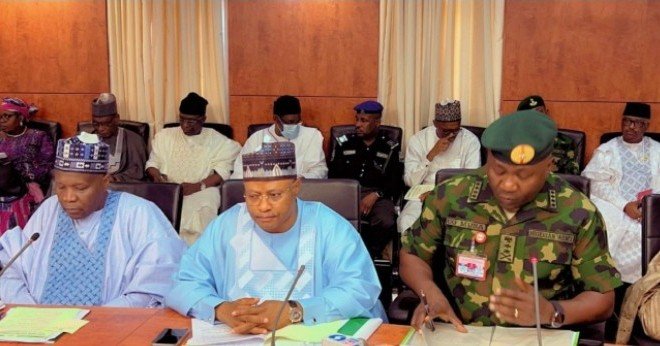

The Northern Governors Forum chaired by Gombe state Governor has rejected the derivation-based model for Value Added tax (VAT) distribution in the new tax bill currently in the National Assembly for deliberation.

In a communique signed by the Chairman of the Forum, Muhammed Inuwa Yahaya, Governor of Gombe state after the meeting between the elders and Governors of the Northern states, the forum frowned at the proposition stating it is against the interest of the North and other sub-nationals.

The forum called on members of the National Assembly to oppose the legislation and any other that jeopardise the interest of the people of the North.

It states, “Forum notes with dismay the content of the recent Tax Reform Bill that was forwarded to the National Assembly. The contents of the Blare against the interests of the north and other sub-nationals especially the proposed amendment to the distribution of Value Added Tax (VAT) to Derivation-based Model. This is because companies remit VAT using location of their headquarters and tax office and not where the services and goods are consumed. In view of the foregoing, the Forum unanimously rejects the proposed Tax Amendments and calls on members of National Assembly to oppose any bill that can jeopardise the well-being of our people.”

The new tax bill currently on the floor of the National Assembly proposed a derivation principle in the distribution of VAT accruals between the federal government and sub-nationals.

Read Also: AFTER 9 DAYS… Northern Leaders Kick Over Power Outage

VAT distribution formular in Nigeria

Currently, according to Section 40 of the VAT Act, revenue is allocated as follows: 15% to the Federal Government, 50% to the States and FCT, and 35% to Local Governments. The distribution to states and local governments reflects a derivation principle of at least 20%.

- Although not explicitly outlined in the VAT Act, other factors influencing the distribution include 50% based on equality and 30% based on population. Additionally, a 4% collection fee is allocated to the FIRS, and 2% to the NCS for import VAT.

States dissatisfaction with current VAT distribution formular and issues arising

Some states mostly in the South have expressed dissatisfaction with the current VAT distribution formular noting that they do not get their fair share.

- In 2021, the Rivers state sued the Federal Inland Revenue Service (FIRS) to the federal high court in Port Harcourt where it got judgement in its favour stating that the Rivers state government is entitled to collect VAT in Rivers state.

The FIRS successfully appealed the judgement of the Port Harcourt high court in the appeal court.

The judgment implied that each state would be responsible for administering VAT within its territory. Consequently, the FIRS would oversee VAT administration in the FCT and on non-import foreign transactions, while the Nigeria Customs Service would continue collecting import VAT on international trade.

The FIRS successfully appealed the judgment of the Port Harcourt high court in the appeal court.